Talk about bad timing: Fresh off raising award rates across the globe, United and Chase have rolled out bigger, limited-time bonuses of up to 80,000 MileagePlus miles on their suite of co-branded credit cards.

From the no-annual-fee United Gateway℠ Card to the top-of-the-line United Club℠ Infinite Card, you can currently get a bigger bonus on the entire lineup. These new limited-time offers are set to end on August 9, 2023 – though we suspect the 60,000-point offer on the Explorer Card will stick around much longer – maybe even for good.

While these aren’t the largest offers we have ever seen on these cards, they’re all solid. And that makes now a good time to pick one of them up if you’re in the market for United miles. Just be warned: These miles won’t go nearly as far as they did just a few weeks ago.

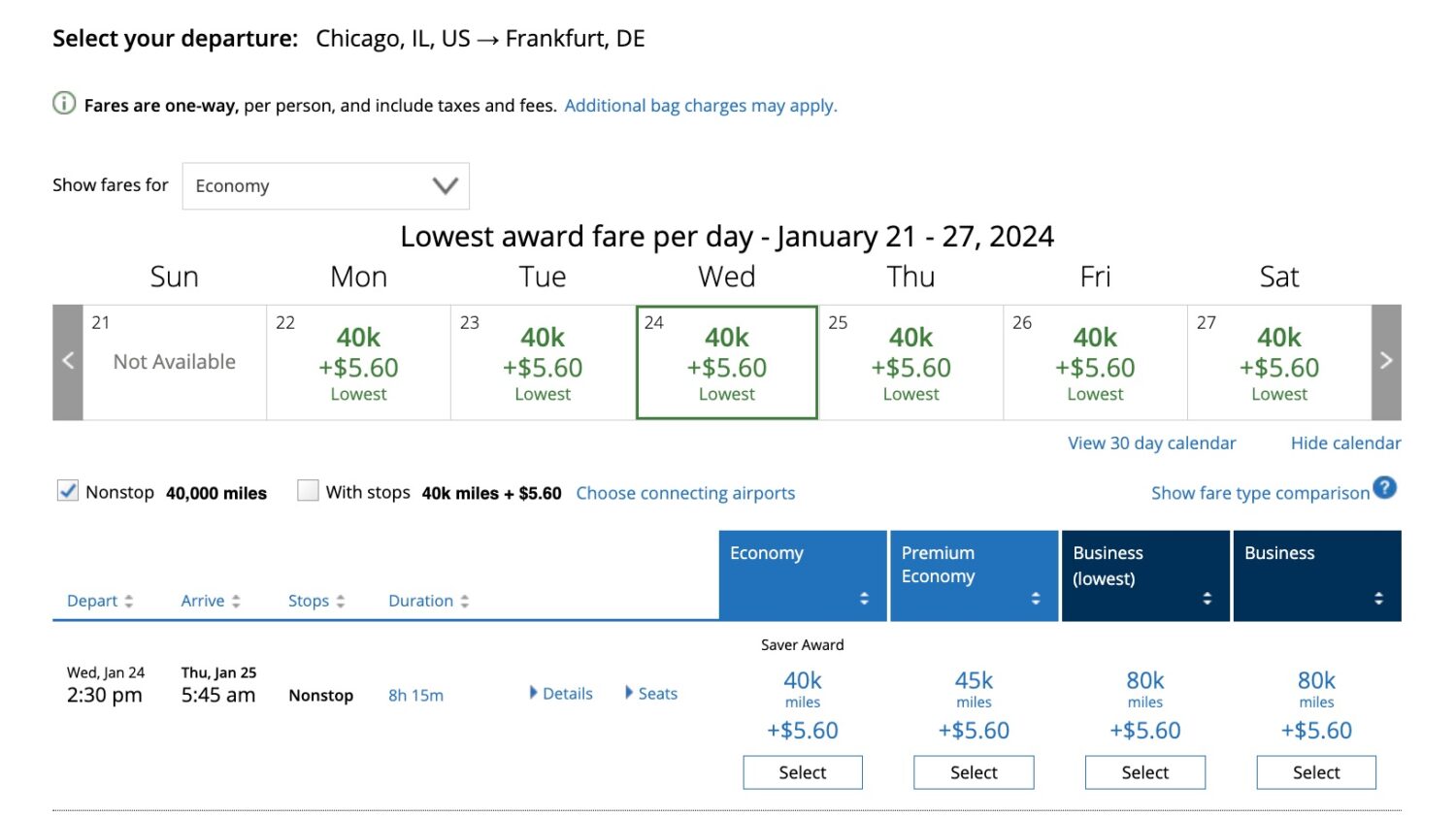

In the last few weeks, we’ve seen United award rates shoot up whether you’re flying to Europe, Asia or Australia – and whether you’re redeeming miles for a United flight or on a partner carrier. Take Europe, for example: Flying United economy used to cost 30,000 miles each way at the lowest “saver” award rates. Those same flights now run 40,000 miles in each direction. Booking United Polaris business class has increased from 60,000 miles each way to 80,000 miles each way.

After delivering such a blow to loyal United flyers, it’s only fitting that they’d try winning back some good favor by giving travelers a way to earn more United miles through these increased card offers, right?

Let’s take a closer look at these cards and see what each has to offer.

United℠ Explorer Card

- Earn 60,000 United MileagePlus miles after you spend $3,000 in purchases in the first three months of card membership.

- Earn 2x miles per dollar spent on dining, hotel stays, and United® purchases

- Up to a $100 credit to cover enrollment in Global Entry, TSA PreCheck, or NEXUS

- First checked bag free on United flights

- Enjoy priority boarding privileges

- Get two, one-time passes to the United Club each year on your cardmember anniversary

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights

- One year of complimentary DashPass, a membership for both DoorDash and Caviar that provides unlimited deliveries with $0 delivery fees and lower service fees on eligible orders. After that, you are automatically enrolled in DashPass at the current monthly rate. Activate by 12/31/24.

- $0 introductory annual fee for the first year, then $95 a year

Click Here to learn more about the United℠ Explorer Card.

United Quest℠ Card

- Earn 70,000 United MileagePlus miles and 500 Premier Qualifying Points (PQPs) after you spend $4,000 in the first three months of card membership.

- Earn 3x miles per dollar spent on United® purchases

- Earn 2x miles per dollar spent on dining, select streaming services & all other travel

- Up to a $100 credit to cover enrollment in Global Entry, TSA PreCheck, or NEXUS

- Each year, receive a $125 credit on United® purchases

- Two 5,000-mile anniversary award flight credits starting in your second year

- First and second checked bag free on United flights

- Get priority boarding privileges on all United flights

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights

- $250 Annual Fee

Click Here to learn more about the United Quest℠ Card

United Club℠ Infinite Card

- Earn 80,000 United MileagePlus miles and 1,000Premier Qualifying Points (PQPs) after you spend $5,000 in the first three months of card membership.

- Earn 4x miles per dollar spent on United® purchases including tickets, Economy Plus, inflight food, beverages and Wi-Fi, and other United charges.

- Earn 2x miles per dollar spent on all other travel

- Earn 2x miles per dollar spent on dining

- Complimentary United Club lounge membership

- Up to a $100 credit to cover enrollment in Global Entry, TSA PreCheck, or NEXUS

- First and second checked bag free on United flights

- Enjoy priority boarding privileges

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights

- $525 Annual Fee

Click Here to learn more about the United Club℠ Infinite Card.

United Gateway℠ Card

- Earn 30,000 United MileagePlus miles after you spend $1,000 in purchases in the first three months of card membership.

- Earn 2x miles per dollar spent on United® purchases

- Earn 2x miles per dollar spent at gas stations

- 25% back as a statement credit on United inflight and Club premium drink purchases

- No annual fee

Click Here to learn more about the United Gateway℠ Card

Should You Apply?

It depends. There are plenty of considerations to keep in mind.

Like all Chase credit cards, the portfolio of United Airlines credit cards are subject to the Chase 5/24 rule. That means if you have been approved for five or more credit cards from any bank (not just Chase) in a 24-month period, you will automatically be declined for any of these cards regardless of your credit score or history with Chase bank.

That’s the big reason we always suggest starting your travel rewards credit card journey with Chase credit cards. They are simply harder to get later on down the line. That alone makes it important to consider these offers.

And assuming you already have a Chase Sapphire Preferred or Reserve and one of the Chase Freedom Cards, one of these United cards could make a ton of sense for filling a Chase 5/24 spot.

But remember, Chase doesn’t allow you to hold more than one of the United personal cards at the same time, so choose wisely. And if you have earned a bonus on any of the United personal cards in the last 24 months, you won’t be eligible to apply.

Read more: Master Guide to Credit Card Applications & All the Rules You Need to Know, Bank by Bank

Another Benefit: Expanded United Award Availability

One of the best benefits of holding a United Airlines co-branded credit card is the increased access it provides to award seats on United Airlines flights.

This means that just for holding the card, you will see more saver-level award seats available when you search for ways to redeem your miles. Oftentimes, there is additional award availability during peak travel times and/or more popular routes. This ultimately means you have to use fewer miles when it comes time to use them.

Finally, United cardholders will get access to all Everyday awards. This means you can use your miles to book seats on any United Airlines flight, even if it’s the last seat on the plane. You may pay a small fortune in miles to do so, but that could come in handy.

Related reading: 5 of the Best Ways to Use United MileagePlus Miles

Bottom Line

The suite of United airlines co-branded credit cards are offering welcome bonuses of up to 80,000 MileagePlus miles, depending on which version of the card you choose.

Recent award devaluations make these offers less exciting than they would have been just a few weeks ago. But there are still plenty of good ways to use United miles and now could be the right time to pad your balance.

Hi Nick,

Thank you for your post. My wife applied for and was approved for the United Explorer card earlier this week. With the bonus miles offer ending tomorrow does that mean she has to spend the $3000 today? Or does it mean today (or some time tomorrow) is the final day to get approval?

Keep up the great work.

Andrew

Hi Andrew. You still have 3 months to meet the spending requirement. You just have until today to get approved for the bigger points offer for spending in the first 3 months.

Don’t spend on a United card until they moderate their huge redemption increases.